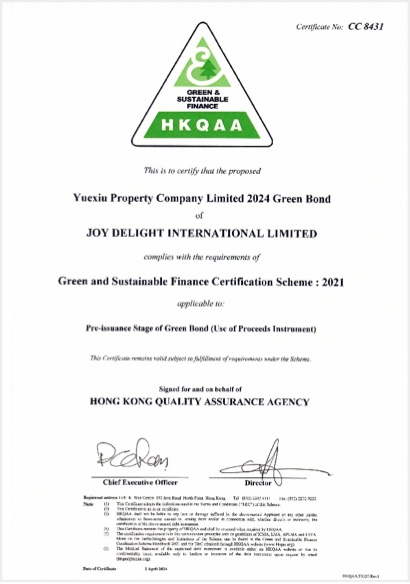

Yuexiu Property successfully issued RMB 1.690 billion 3-year offshore dim sum bonds on July 5, 2024 with coupon rate of 4.10%. This issuance is the first ever green bond issuance of Yuexiu Property and the largest oversea bond issuance in the real estate industry up to now in 2024. The bond is issued in accordance with the guidelines of Yuexiu Property's sustainable finance framework. The equivalent amount of the proceeds will be fully allocated to Yuexiu Property's eligible green projects, including green buildings that meet the China Green Building Three Star Standard. This green bond has also successfully obtained the Green and Sustainable Finance Certification from the Hong Kong Quality Assurance Agency.

Hong Kong Quality Assurance Agency's Green and Sustainable Finance Certification

Yuexiu Property is committed to integrating the concept of sustainability into its financing strategy. The company continues to explore sustainable financing tools such as green bonds, green loans and loans related to sustainability performance, in order to enhance its financial flexibility and resilience, as well as to fully promote the economic transformation towards low carbon, efficient use of resources and sustainable development.

In order to effectively integrate the concept of sustainable development into various dimensions of business development, Yuexiu Property has been steadfastly advancing its ESG work in a full-chain, all-around, and comprehensive manner. In 2024, Yuexiu Property established its first Sustainable Finance Framework, which is planned to finance projects, assets and developments that align with the company’s sustainability vision and strategy through sustainable financing transactions.

Yuexiu Property continues to benchmark against the ever-improving international standards and best practices. In setting up its Sustainable Finance Framework, the company has referred to the voluntary guidelines in the Green Bond Principles (2021), Social Bond Principles (2023) and Sustainability Bond Guidelines (2021) by the International Capital Market Association (ICMA), as well as the Green Loan Principles (2023) and the Social Loan Principles (2023) by the Loan Market Association (LMA), Asia Pacific Loan Market Association (APLMA) and the Loan Syndications and Trading Association (LSTA).

Under the sustainable finance framework, Yuexiu Property has committed to allocate all or a portion of the proceeds from each issuance, or an equivalent amount, exclusively for the financing and refinancing Yuexiu Property's eligible green and social projects, including the acquisition, construction, development or re-development of such projects that deliver clear environmental and social benefits. The eligible green projects include those related to green buildings, climate change adaptation, energy efficiency, and pollution prevention and control, while the eligible social projects include affordable housing.

In 2023, Yuexiu Property achieved over 25% of its bond and loan financing sourced from green finance. To further promote sustainable financial development, Yuexiu Property has established a long-term goal: to achieve at least 50% of its bond and loan financing sourced from green finance by 2030.

In the future, Yuexiu Property will firmly reaffirm its steadfast commitment to achieving sustainable development. The company will strive to create projects that adhere to sustainable development principles, to the benefit of our property owners, tenants, and local communities. Yuexiu Property hopes to make active contributions towards promoting the low-carbon transformation of the entire real estate industry and achieving the green development of business through sustainable financing. The company will continue to explore and implement more innovative carbon emission reduction measures, contributing to the construction of a more sustainable future.