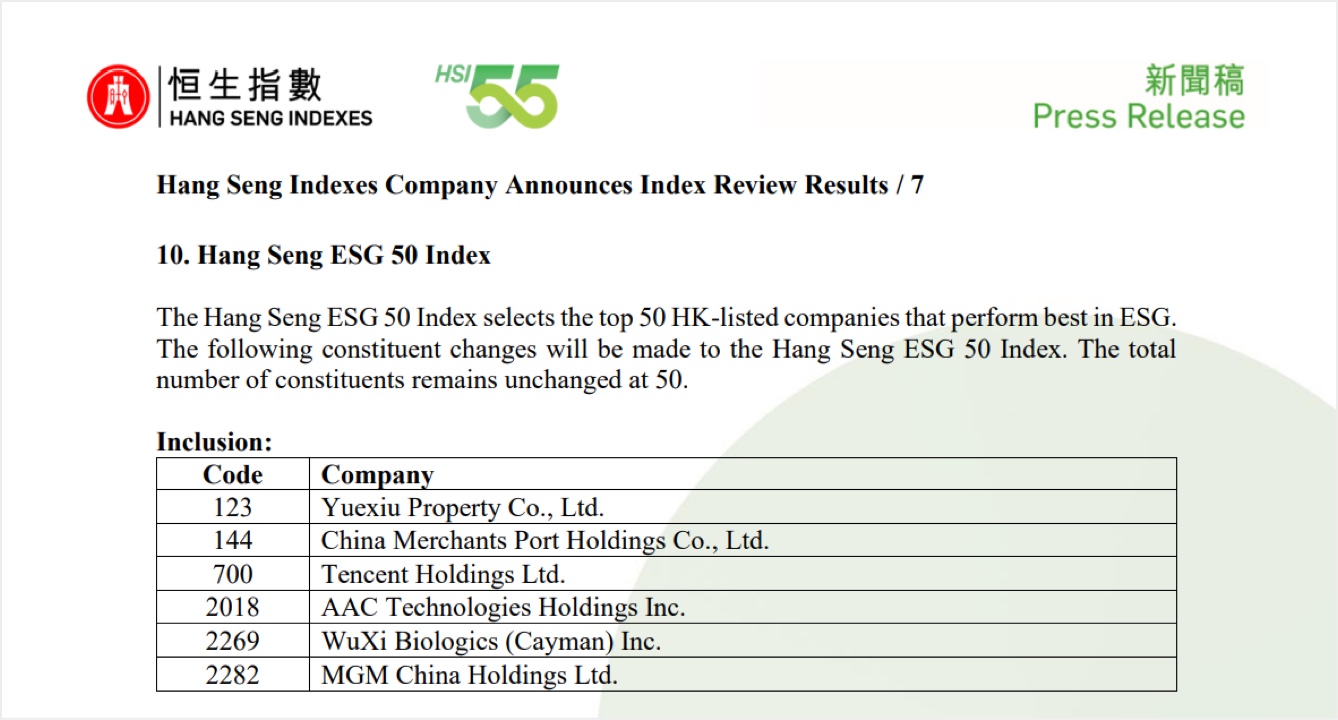

On 16 August, Hong Kong Hang Seng Indexes Company Limited announced the quarterly review results of the Hang Seng Indexes Series for the period ending 30 June 2024, in which Yuexiu Property (00123.HK) has been included as a constituent stock in the “Hang Seng ESG 50 Index” and “Hang Seng Corporate Sustainability Benchmark Index”, the changes will take effect from 9 September 2024. Being concurrently included in these two major Hang Seng Sustainability Indexes undoubtedly signifies a great recognition of Yuexiu Property's efforts and outstanding performance in the ESG field.

About the “Hang Seng ESG 50 Index” and the “Hang Seng Corporate Sustainability Benchmark Index”

The Hang Seng Index is one of the world's major stock indices and has become an important indicator reflecting Hong Kong's stock market performance since its launch in 1969. The “Hang Seng ESG 50 Index” was first launched in July 2020, which selects the top 50 Hong Kong-listed companies as constituent stocks with the best ESG performance from over 2,600 listed companies. Yuexiu Property is one of the only three domestic real estate stocks selected.

The “Hang Seng Corporate Sustainability Benchmark Index” was first launched in September 2011, selecting the top 20% of eligible candidates based on ESG performance, a total of 97 Hong Kong-listed companies have been included in this review. According to historical data, less than 15% of the companies were from the property and construction industry, and only four domestic real estate stocks were included in the list, with Yuexiu Property being one of them.

In recent years, Yuexiu Property has consistently adhered to the principle of sustainable development, and established a comprehensive ESG governance structure under the Board of Directors, with continuous improvement on the level of ESG information disclosure, and focused on the construction of green and low-carbon buildings, ESG digital management and sustainable finance. These efforts have led to significant progress and changes in sustainable development. In 2023, the Global Real Estate Sustainability Benchmark (GRESB) awarded Yuexiu Property a “four-star” rating, ranking second in the residential category in East Asia, Yuexiu Property's ESG performance has been recognised by authoritative international ESG rating agencies.

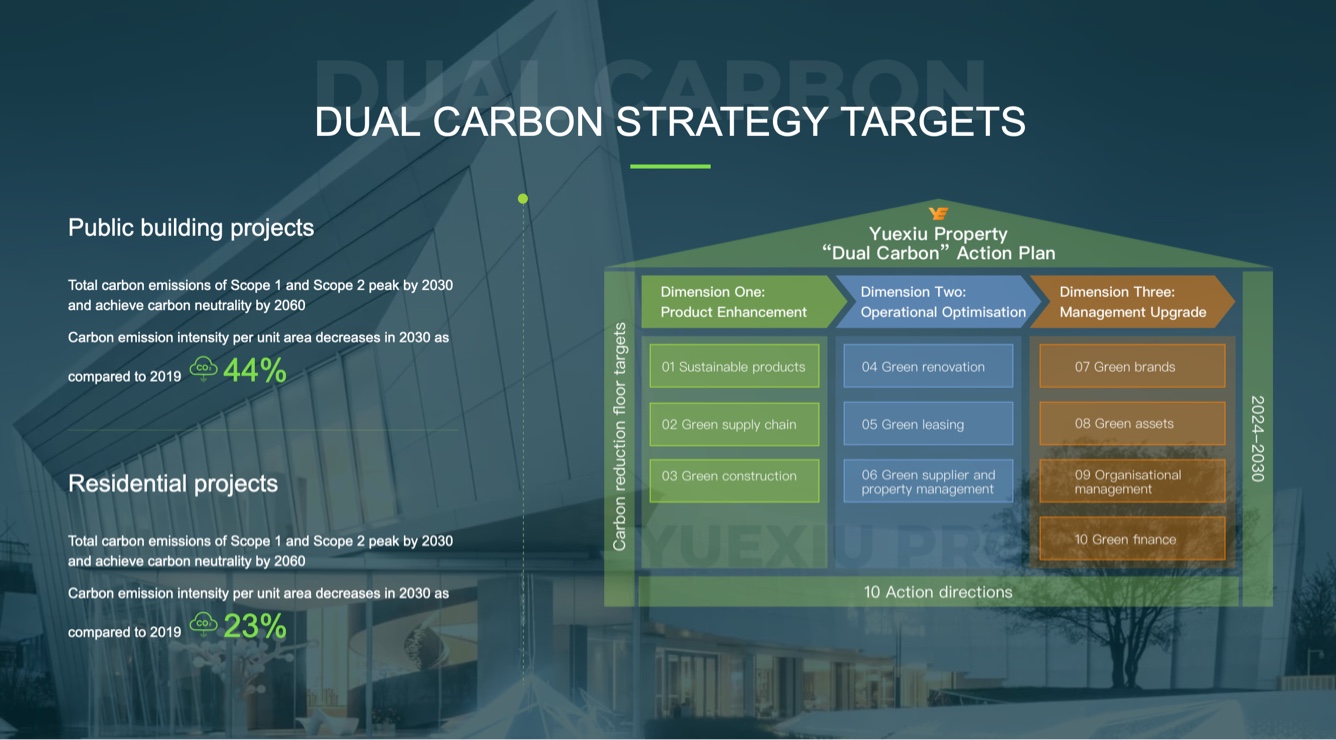

In green and low-carbon practices, Yuexiu Property actively promotes the development and innovation of green buildings, vigorously develops ultra-low-energy buildings, near-zero-energy buildings and double-zero-energy buildings, and is committed to creating a sustainable real estate enterprise throughout the entire life cycle of a building. In its “Yuexiu Property 2023 ESG Report” released in April this year, the company disclosed its carbon reduction targets and “dual-carbon” action plan for the first time: to achieve net-zero emissions across the value chain by 2060 and carbon peak by 2030; to reduce the carbon emission intensity per unit area of Scope 1 and Scope 2 of public building projects by 44% compared with that of 2019, and to reduce the carbon emission intensity per unit area of Scope 1 and Scope 2 of residential projects by 23% compared with that of 2019; Yuexiu Property has designed or constructed a total of 208 projects complying with the green building standards, covering a floor area of 37,473,000 square metres, and has cumulatively designed or constructed 14 ultra-low-energy buildings, 4 near-zero-energy buildings and 1 zero-energy building.

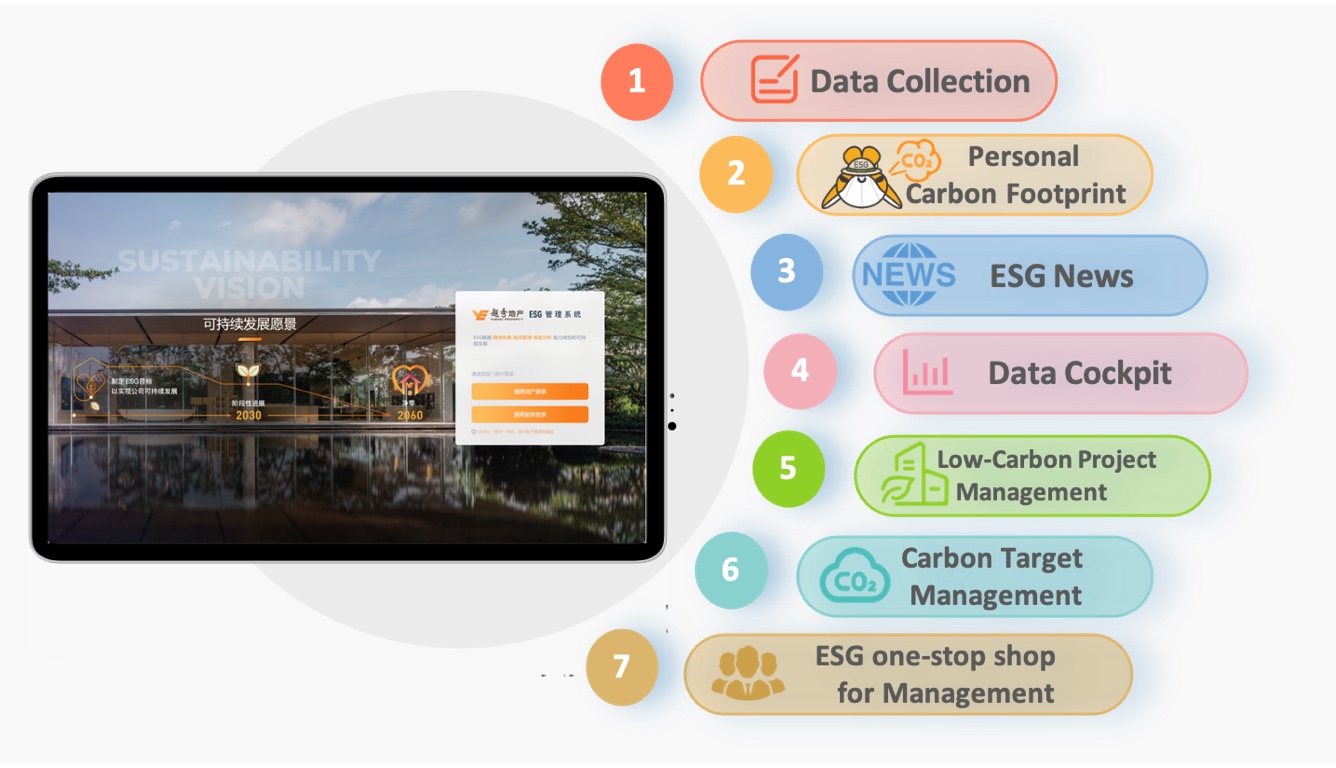

To advance the implementation of its sustainable development strategy and enhance ESG management efficiency, Yuexiu Property empowered its ESG management digitally by launching the “ESG Management System” in September 2023. The system covers “ESG Data Filling Management”, “Personal Carbon Footprint Management”, “ESG News”, “ESG Data Cockpit”, “Low-Carbon Project Reporting” and “Carbon Target Management” modules, which realise the systematic collection and review of ESG data, monitoring and management of energy consumption of commercial projects, management of carbon emission intensity of each industry, collection and management of low-carbon building projects and certification information, and management of personal carbon footprint, as well as sharing the latest internal and external ESG developments with all company employees, which covers the Scope 1, 2 and 3 carbon emissions of the entire value chain, helping the company to better promote the development of ESG and the achievement of the “dual-carbon” target.

In terms of sustainable financial development, Yuexiu Property established its first Sustainable Financing Framework in 2024 and plans to finance projects, assets and developments in line with Yuexiu Property's sustainable development vision and strategy through sustainable financing transactions and successfully issued its inaugural Green Dim Sum Bond in July 2024, raising a total of RMB1,690 million, with a maturity period of 3 years and a coupon interest rate of 4.10%. The Bond in accordance with the guidelines of Yuexiu Property's sustainable finance framework, an equivalent amount of its proceeds will be fully utilised for Yuexiu Property's eligible green projects, including green buildings that meet China Green Building’s Three Star Standard. To better promote sustainable finance development, Yuexiu Property has set a long-term goal to achieve at least 50% of its bond and loan financing from green finance by 2030.

Looking ahead, under the leadership of the company's management, Yuexiu Property will continue to uphold the core principles of sustainable development, continuously deepen and enhance its ESG management system with the entrepreneurial spirit of “Beyond Excellent”, vigorously develop green and low-carbon buildings, green finance and green supply chains. Yuexiu Property is committed to achieving better performance in the field of ESG, attracting more attention from ESG investment institutions and recognition of authoritative ESG rating agencies, and steadfastly moving towards the road of high-quality development.