On 30 January 2026, Yuexiu Property Company Limited (Stock Code: 00123.HK) successfully issued US$250 million equivalent green dim sum bonds for a 3-year term with a coupon rate of 3.40%. Leveraging the Company’s high-quality asset profile and green finance attributes, this issuance attracted enthusiastic subscriptions from a diversified pool of domestic and international investors, achieving an overall book-building peak of nearly twice the issue size. Despite complex market conditions, the final pricing of this issuance was significantly compressed by over 50 basis points compared to the secondary market valuation of the Company’s comparable dim sum bonds issued in 2025. This not only achieved a substantial optimisation of financing costs but also instilled strong confidence into the market, demonstrating the capital market’s high recognition of the Company’s development prospects and creditworthiness.

Significantly Narrowing Issuance Spreads, Setting a Benchmark with the First Issue of the New Year

The Chinese real estate market remains in a phase of deep industry-wide adjustment. Against this backdrop, Yuexiu Property’s successful completion of this issuance – characterised by a robust order book and significantly narrowed issuance spread – strongly demonstrates international capital markets’ high recognition of and firm confidence in the Company’s fundamentals, financial stability, and creditworthiness. This issuance not only marks the first green dim sum bond in China’s real estate sector for 2026 but also represents the inaugural issuance of its kind in the Guangdong-Hong Kong-Macao Greater Bay Area this year, representing a significant milestone.

Green Finance Strategy Deepens as ESG Practices Aain Investor Traction Again

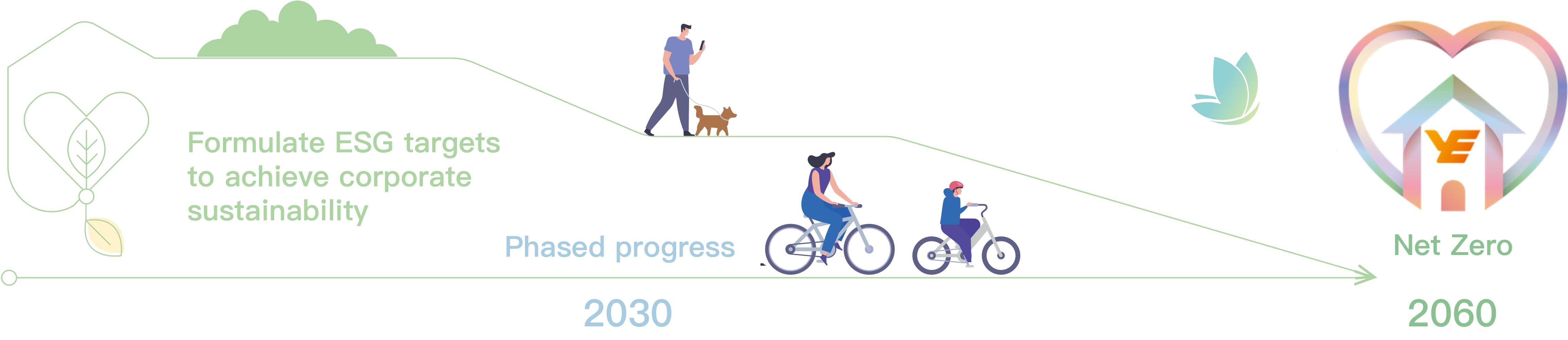

This issuance takes the form of a green bond, with proceeds to be allocated to various environmental projects aligned with the Company’s Sustainable Finance Framework, including green building development, energy efficiency upgrades, and renewable energy applications. This initiative is fully consistent with Yuexiu Property’s long-standing sustainable development strategy. Leveraging its deep expertise in green building and outstanding ESG management performance, the Company has consistently secured high ratings from domestic and international ESG rating agencies, establishing its green brand as a distinct financing advantage. The successful issuance of the green dim sum bonds further demonstrate the Company’s ability to transform ESG value into financial strength, further broadening its financing channels and reducing funding costs.

Hong Kong Quality Assurance Agency Green and Sustainable Finance Certification

Stable Operations Lay the Foundation, while High-quality Development Leads the Future

Management of Yuexiu Property stated, “Amid the current market cycle fluctuations, the successful issuance of this green dim sum bond not only validates our ‘long-termism and stable operations’ strategy but also reflects great recognition from domestic and international investors in Yuexiu Property’s financial resilience, operational strength, and sustainable development path. We will adhere to the green bond framework, efficiently allocate the raised funds, and continue to deepen our green building and low-carbon operational practices. We are committed to delivering sustainable growth to reward our investors for their trust and to join hands with stakeholders in building a shared future.”

About Yuexiu Property

Yuexiu Property is a leading urban integrated operation service provider in China, with a core focus on the Guangdong-Hong Kong-Macao Greater Bay Area while deeply expanding into key cities nationwide. The Company steadfastly promotes implementation of the “Commercial + Residential” development strategy, leveraging its full-chain capabilities in “Development + Operation + Services” to create high-quality living spaces and commercial platforms, thereby continuously driving urban development and renewal.

The Company has deeply integrated sustainability into its strategy and operations. In 2025, it achieved the highest five-star rating in the global real estate sector under the GRESB, an internationally authoritative sustainability assessment system, while also maintaining its inclusion as a constituent stock in the Hang Seng Corporate Sustainability Index Series. Moving forward, Yuexiu Property will continue to implement the “long-term” vision, creating enduring value for the shareholders, customers, and society.